Blogs

After earnings and you may resources meet or you can check here exceed the newest $two hundred,100000 withholding endurance, tend to be all the info your staff stated inside quarter, even although you were unable to withhold the brand new personnel taxation from 0.9%. Enter the earnings, info, sick spend, and you can nonexempt fringe professionals which might be at the mercy of Medicare taxation. As opposed to societal defense earnings, there is no restriction on the quantity of earnings subject to Medicare taxation. The brand new $100,000 tax liability endurance requiring an after that-go out deposit is determined before you can imagine any decrease in their responsibility to own nonrefundable credit. If you file Function 941 electronically, you might age-file and make use of EFW to pay the balance owed within the an excellent single step having fun with taxation planning software or thanks to a tax elite group. More resources for using your own fees having fun with EFW, visit Internal revenue service.gov/EFW.

Investment You to definitely Financial

For individuals who’re revealing one another management errors and you will nonadministrative problems for similar one-fourth out of a prior seasons, go into the total fixed amount in the line step 1. But not, multiply only the quantity of earnings and information stated in the column step three which can be linked to administrative mistakes by 0.009 (0.9% income tax speed). Don’t proliferate one earnings and you can information said within the line step 3 you to is linked to nonadministrative mistakes because of the 0.009 (0.9% tax price).

- Once you discover an RACQ Financial Term Put account, you are going to receive your interest should your name put period finishes (known as ‘maturity’ of the term put), or annually if your identity is more than 1 year.

- The newest Federal Put Insurance policies Company (FDIC) are a separate department created by the new Congress to keep balance and you may public rely on in the country’s financial system.

- The brand new picked speed will apply when your term deposit is actually completely funded.

- FERS handicap retirees have the changes, but while they are choosing an impairment annuity according to sixty percent of the highest-step 3 mediocre paycheck.

How can i get a processing extension because of Direct Pay?

I rated her or him for the requirements along with yearly payment production, minimal stability, charges, electronic experience and much more. When all these criteria are fulfilled, the new FDIC usually guarantee for each and every participant’s interest in the master plan around $250,000, separately of people profile the new company otherwise personnel have in the a similar FDIC-insured business. The new FDIC tend to identifies which coverage while the “pass-due to visibility,” since the insurance coverage experiences the new company (agent) you to founded the brand new membership to the staff that is sensed the new manager of your finance. A proprietor which describes a beneficiary because the having a lifetime property interest in a formal revocable trust try permitted insurance rates to $250,100 regarding recipient. The fresh FDIC brings separate insurance rates to possess fund depositors have in various kinds of judge ownership. Highest efficiency banking institutions encourage might require high lowest deposits to open up an account or secure the gorgeous APY.

To find out more on the applying for an excellent PTIN on the internet, check out Irs.gov/PTIN. You can’t use your PTIN instead of the fresh EIN of your own tax preparing firm. Read the package on the internet 42 for individuals who reclassified one professionals as separate contractors otherwise nonemployees. In addition to go here package should your Irs (or you) determined that professionals you addressed as the separate builders or nonemployees will be be classified as the personnel. On the web 43, give us a detailed reason people employee is actually reclassified and you will, for those who used area 3509 cost to your contours 19–22 for worker reclassified while the a member of staff, establish as to the reasons area 3509 cost pertain and you will exactly what costs your utilized. Should you have an increase to help you societal shelter earnings out of $15,one hundred thousand to have Xavier Black and you may a drop so you can social security earnings away from $5,000 to possess Sophie Flower, you would enter into $ten,100 on the web 8, line step three.

The rate out of Medicare taxation are 1.45% (0.0145) per to your company and you may worker. Were the resources your employees said inside quarter, even although you were unable in order to withhold the new personnel taxation away from step one.45%. Do not is assigned tips (explained inside the part six from Bar. 15) about this line. Allocated info are not reportable for the Setting 941 and are not susceptible to withholding of government earnings, public defense, otherwise Medicare income tax. Businesses inside the American Samoa, Guam, the fresh CNMI, the newest USVI, and you may Puerto Rico can also be ignore lines 2 and you will 3, unless you features group that are susceptible to You.S. tax withholding. Always be yes the new EIN for the function you file exactly matches the brand new EIN the brand new Internal revenue service allotted to your online business.

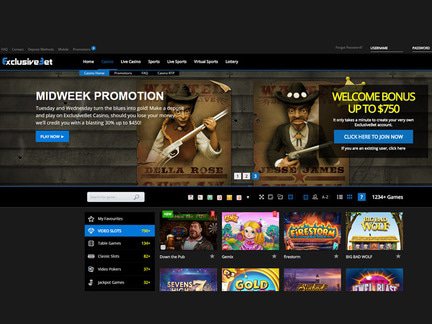

All the information, services and products given on this site commonly meant for shipment to the private in every country otherwise legislation in which such as shipping or fool around with will be in comparison to local rules or regulations. Including but is not limited on the Us from The united states, Canada, Israel, The newest Zealand, Iran, North Korea (Popular Mans Republic out of Korea), and Brazil. Earlier overall performance is no manifestation of coming overall performance and tax laws and regulations is actually subject to transform. All information regarding this web site are general in nature and you can does maybe not account for your own objectives, financial situation otherwise demands. Before performing on people guidance available on this amazing site, we recommend that your search independent suggestions to choose perhaps the information is suitable for your requirements plus individual points. To help you determine your specific deposit insurance policies, you can use the new FDIC’s Electronic Put Insurance rates Estimator (EDIE).

Should your concerns usually do not pertain, log off him or her blank and see Region cuatro. Should your payment agreement are accepted, it’ll cost you a fee and you will be subject in order to punishment and attention on the level of tax not repaid by the due date of one’s return. If line twelve is more than range 13, enter the difference online 14. For many who’re a semiweekly plan depositor, you should done Schedule B (Mode 941).

We received an examination in initial deposit however, I nevertheless can also be’t be sure my family savings. What do i need to do?

Make certain people lowest is actually a cost you might be safe putting on the a great savings account. Either, there are even limits you to definitely limit the money number that can earn the brand new higher APY, thus limiting your own focus-getting potential. Marcus is the consumer banking case out of Goldman Sachs while offering the higher-give bank account and Cds, in addition to a leading-give Video game, a zero-penalty Computer game and you can a Video game allowing speed bumps. Of varying sizes financial institutions across the country offer put accounts supported by FDIC deposit insurance rates. Visibility are automated once you open one sort of profile in the a keen FDIC-insured financial.